"The best debt solution for anyone depends on their particular financial situation. There is no one solution that will often be the best for anyone. Your kick off point should be to have an understanding of the primary debt solutions available and what circumstances they are best suited for. You will then be able to see which choices probably be the best fit for your own personel situation.

I have to get consolidation loans dealt with to start with, as this is often the first thing people consider when they may be hunting for a way to avoid it of debt. It must be declared there's not that many situations where borrowing more income is going to ultimately add in a better position. There are some circumstances if this can be the best option, but these are less frequent than a lot of people imagine.

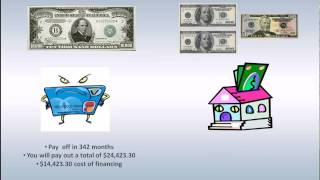

The attraction of which loans may be the prospect of lower monthly payments and just one payment to produce, but when you are not careful you'll be able to pay a high price just for this short-term gain. The problem is that your new loan will mean you're investing in the money you owe on the considerably longer period, with the result that by the time the credit is paid off it has cost you a lot more than you originally owed in your old debts.

A greater prospect is probably be a debt management plan. This too is frequently referred to as debt consolidation, particularly in the US, however it doesn't involve obtaining any new loans. Debt management is the place a company setup a repayment plan for you personally, therefore you just be an individual reduced payment towards the debt solution company as an alternative to to everyone your creditors. The payments on such a plan are lower since the company negotiates along with your creditors to set up more favourable terms for your repayment of your debts. You usually turn out paying less in interest and also other charges, which means that your particular monthly outgoings are reduced.

This is normally deemed the top debt solution for substantial quantities of consumer debt, because it is an informal arrangement which may be modified should your circumstances change. Unsecured debts include virtually any debts that don't possess a legal binding with a valuable asset as security. Mortgages usually are not unsecured because they're associated with your house, that may be repossessed in case you default on payments.

To be regarded as for a debt relief plan you'll need to have a very income source which is sufficient to pay for your normal monthly outgoings and also the payment necessary for plan. Some people discover that their situations are in a way that they only would not have enough spare money for the necessary payments. For these people the best debt option would be apt to be credit card debt settlement if they're in the US or perhaps an Individual Voluntary Arrangement (IVA) if they are in the UK.

Debt coverage is quite different to debt relief for the reason that the key idea is to find agreement to write down off as much of the debt as you can, as opposed to attempting to pay it off all. This is a process undertaken by debt consolidation companies who may have skilled negotiators working on your behalf to agree deals with creditors. The incentive they normally use to persuade creditors to settle is the agreed settlement amount will probably be paid in the one time payment. Their other incentive is always that while confronting people facing possible bankruptcy, they know that getting at least area of the money-back can be a more desirable prospect than perhaps getting next to nothing when they go bankrupt.

To make it possible to the settlement amounts you simply must stop paying creditors once you begin with a debt settlement program, and place money instead into another holding account. This can then build up over the time period of the negotiations and stay used to generate settlement payments as terms are agreed.

The other option I mentioned for UK residents can be an IVA, which to all intents and purposes does the identical job as credit card debt settlement. This is a formal agreement only available in the UK, whereby you are making a fixed payment amount that goes towards your finances, but following the agreement your remaining debts are wiped off.

Both debt settlement and IVAs focus on people in grave situations who are certainly not managing to maintain their debt repayment and who might otherwise face bankruptcy. Debt management is perfect for people who will be being affected by substantial debt but do have a very steady income. All of these options are only really suitable for unsecured debts, for example money owed to card companies https://www.washingtonpost.com/newssearch/?query=https://www.nerdwallet.com/blog/loans/payoff-debt-consolidation-personal-loan-review/ or creditors and the best debt solution in your case will be based which situation you're in. Whichever option you might need, you will need to make a plan to find the most effective debt solution company you should to be effective on your behalf.

Taking value the way you pick a debt company is absolutely vital as there are some that are simply not great yet others who're verging on being scam artists. It is easy to avoid such companies by making use of only organisations which have been recommended following thorough research.& If you start out with a list of the most effective debt solution companies, considered to be probably the most reputable and ethical, you are able to then sign up for three or higher of these, that can supply you with the opportunity to generate a comparison. Applying online is quite easy and puts you under no obligation to proceed.| It has happened to numerous us. Life is going good. You feel invincible. You allow your credit card debt to develop beyond exactly what you need. Then things take a turn for the worse and also you realize you can don't afford to cover your obligations. And now you feel no one is able out. I understand what you will be feeling. I have been through it as well. Just know this - there are methods out. Life is not over. Money is not everything. Take a deep breath and resolve to find the proper path back to financial independence. Here are 5 options to getting debt relief:

1) Debt Stacking. You may have also heard it known as the Debt Snowball. This option is much more suited for your individual/couple that's seeking to get debt free but is not necessarily in dire straits. The concept is rather simple but requires discipline. It is a basic accounting principle. List all of your debts on a small note. Now order those debts from highest interest to lowest (a different is usually to order your financial situation from lowest balance to highest). Next to each account write the minimum payment required. Now see how far more you'll be able to afford to pay for towards your finances above the sum of the minimum payments. Now continue paying your financial situation but position the entire additional amount you have budgeted to pay for towards your credit card debt on the debt near the top of your list and pay exactly the minimum on the rest. Continue to do so unless you pay back the initial debt. Now consider the entire amount you had previously paid towards that 1st debt and hang that amount for the second. Continue this method along the list until your debts are entirely paid off. It may sound simple, however the concept is extremely powerful. By using this option you will take years over time it would take to pay off your debt and save you thousands in interest.

2) Debt Consolidation. This is an option in places you take all of your debts and combine them into one loan having a lower monthly interest. This option has it's advantages and also disadvantages. The advantage is that it will typically not hurt your credit of course, if disciplined, allow you to pay off your pinnacleonefunding.com debt sooner. The disadvantages are that 1) we're all not discipline enough and sometimes just go out and borrow more compounding the problem, and two) some of the loan consolidation is secured against your home. This means that you are going to probably convert consumer debt (ie charge cards, medical bills, etc) that is more easily discharged through bankruptcy or settled through debt consolidation into secured debt that puts your individual home at an increased risk in case you default.

3) Debt Management Plan. Debt Management typically involves a third-party company (usually non-profit) negotiating a lower interest rate and/or longer payment period on your debt. This helps one to lessen your payment. The company is paid from your creditors directly because of their services. The advantages for this option is that you are able to spend off your credit card debt without excessive creditor harassment or minus the chance of getting sued for non-payment of debt. The disadvantage is it will typically harder to pay for your debts off, hurt your credit score, in case you miss a payment the creditors usually have the legal right to revert to the old terms of the agreement along with the company letting you often is beholden with their boss - your creditors.

4) Debt Settlement. Debt Settlement involves you (or possibly a third-party company you hire) settling the debt on an amount 40-60% less than what you owe. With Debt Settlement, you stop paying your creditors and begin putting away funds in a settlement account you own to stay with creditors. As the account grows, creditors is going to be settled individually. The advantages to debt negotiation are that you just typically pay back your financial troubles in a shorter amount of time and pay lower than your initial principal. You also maintain charge of your settlement since money is placed into an arrangement account owned by you instead of sending the crooks to your creditors. The disadvantages are that it's going to hurt your credit (since creditors typically won't settle until you are near least a few months late), that you are going to have to handle creditors' collection practices, and, in case you hire a company to help you, you'll have to pay that company any where from 10-20% of your credit card debt amount.

5) Bankruptcy, Chapter 7 or 13. I is not going to get too thorough here simply because this choices legally complicated. Basically a chapter 7 necessitates the court liquidating your assets to spend your creditors. Chapter 7 allows for you to definitely exempt some personal property and thus depending on your situation this is the most suitable choice in your case or may be the worst option. A Chapter 13 involves the court ordering your creditors to simply accept a court generated repayment plan.

It is important to look for legal services prior to choosing these options and particularly before contemplating bankruptcy. Being deep in Debt can feel being a scary thing without end in sight. However, you can find options along with your not alone. Seek help and set it in perspective. Good luck!

"